All awards granted to named executive officers since 2012 under our long-term incentive compensation program are subject to forfeiture or recoupment in the event of misconduct resulting in a restatement of the Corporation’s financial statements and certain other types of misconduct. Such awards also are subject to forfeiture and recoupment provisions relating to“ex-post” risk, meaning risk resulting from the recipient’s inappropriate risk-taking that does not materialize until after the performance period in which such inappropriate risk-taking takes place. Additionally, since 2013, all restricted stock unit awards to named executive officers are subject to forfeiture or recoupment if it is determined that the applicable named executive officer has engaged in inappropriate risk-taking which resulted in certain events deemed to be “significant risk outcomes.” An analysis of significant risk outcomes is completed annually to determine if such significant risk outcomes were tied to inappropriate risk-taking. The results of this analysis are reviewed by the Compensation and Benefits Committee.

With respect to long-term incentive compensation awards made prior to February 21, 2017, the foregoing forfeiture and recoupment requirements are contained in the individual award agreements between the Corporation and our named executive officers. Forfeiture and recoupment requirements applicable to long-term incentive compensation awards made on or after such date are contained in the Policy on Recoupment adopted by the Compensation and Benefits Committee on February 20, 2017. Effective February 19, 2018, the Policy on Recoupment was amended to provide that awards under our short-term incentive compensation programs made on or after such date are also subject to each of the forfeiture and recoupment requirements described above.

Hedging Policy

We maintain a Securities Transactions Policy and Procedures which, among other things, prohibits directors, employees, and certain of their family members from engaging in short selling, margining, pledging or hypothecating our securities, and from trading in options, warrants, puts, calls or similar instruments on our securities.

Compensation and Benefits Committee Report

The Compensation and Benefits Committee is responsible for providing oversight of the compensation of the directors and executive officers of the Corporation. In fulfilling its oversight responsibilities, the Committee has reviewed and discussed with management the Compensation Discussion and Analysis contained in this Proxy Statement. Based upon this review and discussion, the Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Corporation’s Annual Report on Form10-K for the fiscal year ended December 31, 2017, and this Proxy Statement for the 2018 Annual Meeting of Stockholders, each of which is filed with the SEC.

Compensation and Benefits Committee

Charles A. Tribbett III (Chair)

Linda Walker Bynoe

Thomas E. Richards

John W. Rowe

Martin P. Slark

Summary Compensation Table

The following table sets forth the information concerning the compensation paid to or earned by the named executive officers for 2017, 2016 and 2015.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position(1) | | Year | | | Salary ($) | | | Bonus ($)(2) | | Stock Awards ($)(3) | | Option Awards ($)(4) | | | Non-Equity Incentive Plan Compensation ($)(5) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(6) | | | All Other Compensation ($)(7) | | | Total ($) | |

Frederick H. Waddell Chairman | | | 2017 | | | $ | 1,000,000 | | | — | | $4,860,120 | | $ | 1,603,842 | | | $ | 2,850,000 | | | | $1,444,456 | | | $ | 92,265 | | | $ | 11,850,683 | |

| | | 2016 | | | | 1,000,000 | | | — | | 5,400,067 | | | 1,637,386 | | | | 2,700,000 | | | | 333,477 | | | | 96,392 | | | | 11,167,322 | |

| | | 2015 | | | | 993,750 | | | $2,413,689 | | 4,987,508 | | | 1,477,612 | | | | 2,800,000 | | | | — | | | | 87,991 | | | | 12,760,550 | |

Michael G. O’Grady President and Chief Executive Officer | | | 2017 | | | | 800,000 | | | — | | 2,362,562 | | | 779,644 | | | | 1,250,000 | | | | 98,968 | | | | 30,687 | | | | 5,321,861 | |

| | | 2016 | | | | 606,250 | | | — | | 1,687,561 | | | 511,696 | | | | 955,000 | | | | 80,023 | | | | 24,750 | | | | 3,865,280 | |

| | | 2015 | | | | 600,000 | | | 724,107 | | 1,500,037 | | | 444,407 | | | | 1,000,000 | | | | 62,938 | | | | 18,000 | | | | 4,349,489 | |

S. Biff Bowman Chief Financial Officer | | | 2017 | | | | 625,000 | | | — | | 1,518,771 | | | 501,209 | | | | 900,000 | | | | 713,100 | | | | 29,245 | | | | 4,287,325 | |

| | | 2016 | | | | 568,750 | | | — | | 1,687,561 | | | 511,696 | | | | 825,000 | | | | 434,598 | | | | 26,507 | | | | 4,054,112 | |

| | | 2015 | | | | 537,500 | | | — | | 1,500,037 | | | 444,407 | | | | 850,000 | | | | 31,870 | | | | 20,545 | | | | 3,384,359 | |

Steven L. Fradkin President—Wealth Management | | | 2017 | | | | 625,000 | | | — | | 1,620,128 | | | 534,621 | | | | 1,100,000 | | | | 1,235,854 | | | | 30,532 | | | | 5,146,135 | |

| | | 2016 | | | | 606,250 | | | — | | 1,687,561 | | | 511,696 | | | | 950,000 | | | | 733,694 | | | | 28,543 | | | | 4,517,744 | |

| | | 2015 | | | | 600,000 | | | 724,107 | | 1,500,037 | | | 444,407 | | | | 1,000,000 | | | | 21,367 | | | | 22,652 | | | | 4,312,570 | |

Jana R. Schreuder Chief Operating Officer | | | 2017 | | | | 750,000 | | | — | | 2,193,750 | | | 723,965 | | | | 1,000,000 | | | | 1,292,895 | | | | 38,470 | | | | 5,999,080 | |

| | | 2016 | | | | 693,750 | | | — | | 2,250,081 | | | 682,256 | | | | 950,000 | | | | 765,294 | | | | 37,562 | | | | 5,378,943 | |

| | | 2015 | | | | 656,250 | | | 724,107 | | 1,875,028 | | | 555,495 | | | | 1,000,000 | | | | 8,270 | | | | 34,588 | | | | 4,853,738 | |

(1) Positions reflected in this column reflect current positions. Mr. Waddell served as the Corporation’s Chairman and CEO for the entirety of 2017. Effective January 1, 2018, Mr. Waddell stepped down from the position of CEO, with Mr. O’Grady succeeding him in that capacity. Mr. O’Grady has served as President of the Corporation since January 1, 2017, and prior to that had served as President of the Corporation’s Corporate & Institutional Services business from 2014–2016. Further discussion with respect to the Corporation’s leadership transition is set forth under “Board Leadership Structure” beginning on page 20.

(2) Amounts in this column represent long-term cash incentive awards, granted in February 2012 for 2011 performance, which vested in February 2015. Long-term cash incentive awards were granted to named executive officers in February 2012 due to changes in the long-term incentive compensation plan design and no such awards have been granted since February 2012. The amount of the award granted to each named executive officer in February 2012 is as follows: Mr. Waddell: $2,333,333; Mr. O’Grady: $700,000; Mr. Fradkin: $700,000; and Ms. Schreuder: $700,000. Amounts in this column also include interest credited on such awards from the date of grant through the vesting date at a rate equal to themid-term applicable federal rate for the month of February 2012, compounded annually, in accordance with the terms of such awards.

(3) Amounts in this column represent the grant date fair value of the restricted stock unit and performance stock unit awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Stock Compensation (“FASB ASC Topic 718”). See “Note 22—Share-Based Compensation Plans” to the consolidated financial statements included in Item 8 of the Corporation’s Annual Report on Form10-K for the year ended December 31, 2017 for a discussion of the assumptions made by the Corporation in the valuation of these stock unit awards. This column includes the following amounts in 2017 with respect to performance stock units, which

are based on achievement of target performance levels: Mr. Waddell: $3,240,080; Mr. O’Grady: $1,575,041; Mr. Bowman: $1,012,514; Mr. Fradkin: $1,080,056; and Ms. Schreuder: $1,462,500. If the maximum level of performance were attained, the value of the performance stock units would be as follows: Mr. Waddell: $4,860,119; Mr. O’Grady: $2,362,562; Mr. Bowman: $1,518,771; Mr. Fradkin: $1,620,128; and Ms. Schreuder: $2,193,751. See the narrative under “Description of Certain Awards Granted in 2017” beginning on page 57 of this Proxy Statement for more information on these awards.

(4) Amounts in this column represent the grant date fair value of the option awards computed in accordance with FASB ASC Topic 718. See “Note 22—Share-Based Compensation Plans” to the consolidated financial statements included in Item 8 of the Corporation’s Annual Report on Form10-K for the year ended December 31, 2017 for a discussion of the assumptions made by the Corporation in the valuation of these option awards. See the narrative under “Description of Certain Awards Granted in 2017” beginning on page 57 of this Proxy Statement for more information on these awards.

(5) Amounts in this column represent the annual cash incentives earned by the named executive officers in the applicable years under the Management Performance Plan.

(6) Amounts in this column represent the aggregate increase in actuarial present values of accumulated benefits under the Pension Plan and the Supplemental Pension Plan. At December 31, 2015, the applicable discount rate increased to 4.71%, resulting in a decrease in the present value of benefits under the Traditional Formula for each named executive officer relative to December 31, 2014, except for Mr. O’Grady, whose benefits are accrued under the Pension Plan’s “Pension Equity Plan (PEP) Formula.” This decrease was more than offset by increases in the present value of benefits attributable to other factors for Mr. Bowman, Mr. Fradkin, and Ms. Schreuder, while the present value of benefits for Mr. Waddell decreased by $387,577. At December 31, 2016 and December 31, 2017, the applicable discount rate decreased to 4.46% and 3.79%, respectively, resulting in an increase in the present value of benefits under the Traditional Formula. See “Pension Benefits” beginning on page 63 of this Proxy Statement for additional information.

(7) The following table sets forth a detailed breakdown of the items which comprise “All Other Compensation” for 2017.

| | | | | | | | | | | | | | | | |

| Name | | Contributions to TIP and Supplemental TIP ($)(a) | | | Perquisites and Other Personal Benefits ($)(b) | | | Tax Reimbursements ($)(c) | | | Total ($) | |

Mr. Waddell | | $ | 30,000 | | | $ | 41,104 | | | $ | 21,161 | | | $ | 92,265 | |

Mr. O’Grady | | | 24,000 | | | | 6,640 | | | | 47 | | | | 30,687 | |

Mr. Bowman | | | 18,750 | | | | 9,581 | | | | 914 | | | | 29,245 | |

Mr. Fradkin | | | 18,750 | | | | 11,380 | | | | 402 | | | | 30,532 | |

Ms. Schreuder | | | 22,500 | | | | 15,609 | | | | 361 | | | | 38,470 | |

(a) Includes matching contributions made by the Corporation on behalf of named executive officers participating in TIP and Supplemental TIP.

(b) With respect to Mr. Waddell, represents financial consulting and tax return preparation services ($16,500) and personal use of company automobiles ($24,604). With respect to Mr. O’Grady, represents financial consulting and tax return preparation services ($6,500) and personal use of

company automobiles ($140). With respect to Mr. Bowman, represents financial consulting and tax return preparation services ($8,900), including tax preparation services in conjunction with an overseas assignment, and personal use of company automobiles ($681). With respect to Mr. Fradkin, represents financial consulting and tax return preparation services ($10,925) and personal use of company automobiles ($455). With respect to Ms. Schreuder, represents financial consulting and tax return preparation services ($15,140) and personal use of company automobiles ($469).

(c) Represents tax reimbursements provided in connection with personal use of company automobiles and, with respect to Mr. Bowman, taxable expenses relating to an overseas assignment.

Grants of Plan-Based Awards

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Estimated Possible Payouts UnderNon-Equity Incentive Plan Awards (1) | | | Estimated Future Payouts

Under Equity Incentive

Plan Awards (2) | | | All Other Stock Awards: Number of Shares of Stock or Units (#)(3) | | | All Other Option Awards: Number of Securities Underlying Options (#)(4) | | | Exercise or Base Price of Option Awards ($/sh) | | | Grant Date Fair Value of Stock and Option Awards ($)(5) | |

| Name | | Grant Date | | | Thres- hold ($) | | | Target ($) | | | Maximum ($) | | | Thres- hold (#) | | | Target (#) | | | Maximum (#) | | | | | |

Mr. Waddell | | | — | | | | | | | $ | 2,700,000 | | | $ | 7,194,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 83,621 | | | $ | 88.06 | | | $ | 1,603,842 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 18,397 | | | | | | | | | | | | 1,620,040 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | 9,199 | | | | 36,794 | | | | 55,191 | | | | | | | | | | | | | | | | 3,240,080 | |

Mr. O’Grady | | | — | | | | | | | | 955,000 | | | | 4,796,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 40,649 | | | | 88.06 | | | | 779,644 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,943 | | | | | | | | | | | | 787,521 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | 4,472 | | | | 17,886 | | | | 26,829 | | | | | | | | | | | | | | | | 1,575,041 | |

Mr. Bowman | | | — | | | | | | | | 825,000 | | | | 3,597,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 26,132 | | | | 88.06 | | | | 501,209 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 5,749 | | | | | | | | | | | | 506,257 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | 2,875 | | | | 11,498 | | | | 17,247 | | | | | | | | | | | | | | | | 1,012,514 | |

Mr. Fradkin | | | — | | | | | | | | 950,000 | | | | 3,597,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 27,874 | | | | 88.06 | | | | 534,621 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 6,133 | | | | | | | | | | | | 540,072 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | 3,067 | | | | 12,265 | | | | 18,398 | | | | | | | | | | | | | | | | 1,080,056 | |

Ms. Schreuder | | | — | | | | | | | | 950,000 | | | | 4,796,000 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 37,746 | | | | 88.06 | | | | 723,965 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | | | | | | | | | | | | | 8,304 | | | | | | | | | | | | 731,250 | |

| | | 2/21/2017 | | | | | | | | | | | | | | | | 4,152 | | | | 16,608 | | | | 24,912 | | | | | | | | | | | | | | | | 1,462,500 | |

(1) These columns show information regarding payouts under the Management Performance Plan. The amount set forth under the Maximum column represents the highest potential payout under the plan based on the Corporation’s 2017 performance. Although the plan does not provide for a target or threshold, the amount set forth under the Target column represents the amount actually awarded to the named executive officer in 2017 in respect of 2016 performance.

(2) The amounts set forth under the Threshold, Target and Maximum columns represent the number of shares of common stock that would be paid out under the performance stock units granted in February 2017 if the Corporation achieves a three-year return on equity of 7.5%, 12.0% or 15.0% or greater, respectively.

(3) This column shows the number of restricted stock units granted to the named executive officers in 2017.

(4) This column shows the number of shares that may be issued to the named executive officers upon exercise of stock options granted in 2017.

(5) Represents the grant date fair value of each equity award, computed in accordance with FASB ASC Topic 718 (using the target level of performance for performance stock unit awards), disregarding any estimated forfeitures.

Description of Certain Awards Granted in 2017

Performance Stock Units

Each performance stock unit constitutes the right to receive a share of the Corporation’s common stock and vests over a three-year performance period, subject to satisfaction of specified performance targets (“performance conditions”) that are a function of return on equity, and continued employment until the end of the vesting period. Dividend equivalents granted to named executive officers in 2017 will be deferred into a cash account and paid at the time the award vests only with respect to the portion of the cash account attributable to performance stock units that actually vest upon satisfaction of the applicable performance conditions. For awards granted in 2017, accrued dividend equivalents are credited with interest at a rate equal to themid-term applicable federal rate for the month in which the grant was made, compounded annually.

For awards granted to named executive officers in 2017, if during the performance period the executive terminates employment under certain circumstances entitling the executive to benefits under the Corporation’s severance plan, such executive’s performance stock units will be eligible for pro rata vesting (with an extra twelve months of vesting) and distribution at the end of the performance period, subject to certain conditions, including satisfaction of the performance conditions. Upon the death or disability of an executive during the performance period, or if an executive retires after satisfying applicable age and service requirements, such executive’s performance stock units will be eligible for full vesting and distribution at the end of the performance period, subject to certain conditions, including satisfaction of the applicable performance conditions.

Upon a change in control, a pro rata portion of each performance stock unit award (based on actual performance during the portion of the performance period that has elapsed as of the change in control) will be converted into an award with respect to the acquirer of an equal economic value. The remainder of the performance award converts at the target level of performance specified in the performance stock unit agreement into an award with respect to the acquirer of an equal economic value. Both the portion of each performance stock unit award that is based on actual performance and the portion that is based on the target level of performance vest subject only to the continued employment of the recipient through the remainder of the applicable performance period, and are paid out at the end of the performance period, subject to acceleration of vesting upon a qualifying termination, in which event the units are distributed at that time. In the event that a change in control occurs and the acquirer refuses or is unable to agree to the foregoing conversion and vesting provisions, the award will be vested at the time of the change in control. The foregoing notwithstanding, each of our current named executive officers is party to an employment security agreement, which specifies that in the event of a change in control all performance stock units granted to such named executive officer would become fully vested. See “Potential Payments Upon Termination of Employment or a Change in Control of the Corporation” beginning on page 69 for further information.

Restricted Stock Units

Restricted stock units granted to our named executive officers in 2017 vest 50% on the third anniversary of the date of grant and 50% on the fourth anniversary of the date of grant. Awards granted on or after February 20, 2018 will vest 25% each year for four years. Each restricted stock unit award entitles an executive to receive one share of common stock when the award vests, subject to continued

employment until the end of the vesting period. Dividend equivalents on these restricted stock units are deferred into a cash account and paid at the time the awards vest, only with respect to the portion of the cash account attributable to restricted stock units that actually vest. For awards granted to named executive officers in 2017, accrued dividends are credited with interest at a rate equal to themid-term applicable federal rate for the month in which the grant was made, compounded annually.

For awards granted to named executive officers in 2017, if during the vesting period an executive terminates employment under certain circumstances entitling the executive to benefits under the Corporation’s severance plan, the executive will be entitled to receive a distribution of a prorated number of restricted stock units which will provide for an extra twelve months of vesting. In addition, if an executive retires after satisfying applicable age and service requirements, such executive’s restricted stock units will continue to vest in accordance with their terms. Upon the death or disability of an executive during the vesting period, such executive will be entitled to the full vesting and distribution of any unvested restricted stock units.

Upon a change in control of the Corporation, all restricted stock units granted to executive officers will, under the terms and conditions of the applicable award agreements, be converted into units of the acquirer and continue to vest in accordance with the regular vesting schedule; provided, however, that they become fully vested in connection with a change in control if the executive experiences a qualifying termination of employment following the change in control (in which case they are distributed within sixty days). In the event that a change in control occurs and the acquirer refuses or is unable to agree to the foregoing conversion and vesting provisions, the award will be vested at the time of the change in control. The foregoing notwithstanding, each of our current named executive officers is party to an employment security agreement which specifies that in the event of a change in control all restricted stock units granted to such named executive officer would become fully vested. See “Potential Payments Upon Termination of Employment or a Change in Control of the Corporation” beginning on page 69 for further information.

Stock Options

All stock options granted to named executive officers in 2017 had an exercise price equal to the closing sale price of the common stock on the date of grant and expire ten years after the date of the grant. Stock options generally vest in equal annual installments over a four-year vesting period, subject to continued employment until the end of the vesting period.

If an executive retires after satisfying applicable age and service requirements, the executive’s outstanding stock options continue to vest in accordance with their terms and, once vested, may be exercised until the earlier of five years following retirement or the expiration date of the option. If the executive’s employment is terminated under certain circumstances entitling the executive to severance benefits, the executive’s stock options (whether vested or unvested) may be exercised until the earlier of 180 days following termination of employment or the expiration date of the option, provided that if the executive is retirement eligible upon his or her termination of employment under the severance plan, the executive’s stock options (whether vested or unvested) become vested upon the executive’s termination of employment and may be exercised until the earlier of five years from the executive’s effective date of retirement or the expiration of the option. If an executive dies or becomes disabled, the executive’s outstanding stock options become vested and may be exercised until the earlier of five years following death or disability or the expiration date of the option. In other instances, in the

absence of a change in control, vested stock options expire on the earlier of three months following termination of employment or the expiration date of the option, and unvested stock options expire on termination of employment.

Upon a change in control of the Corporation, all stock options granted to named executive officers convert to options relating to the stock of the acquirer and continue to vest in accordance with the regular vesting schedule; provided, however, that they become fully vested in connection with a change in control if the executive experiences a qualifying termination of employment following the change in control (in which case the options on the acquirer stock remain exercisable until the expiration of the option), or if they are not assumed in the transaction (in which case the employee is entitled to a cash payment equal to the “spread” between the transaction consideration and the option exercise price). The foregoing notwithstanding, each of our current named executive officers is party to an employment security agreement which specifies that in the event of a change in control all options granted to such named executive officer would become fully vested. See “Potential Payments Upon Termination of Employment or a Change in Control of the Corporation” beginning on page 69 for further information.

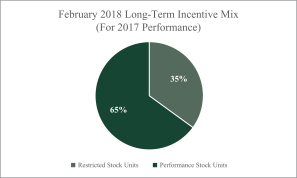

As discussed under “Long-Term Incentive Compensation” beginning on page 46, we have discontinued the use of stock options as a component of our long-term incentive compensation program beginning with the long-term incentive compensation grants made in February 2018 for 2017 performance.

Outstanding Equity Awards at FiscalYear-End

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | Option Awards | | | Stock Awards | |

| | | | | | | | | |

| Name | | Number of

Securities

Underlying

Unexercised

Options

Exercisable (#) | | | Number of Securities

Underlying

Unexercised

Options

Unexercisable (#) | | Option

Exercise

Price ($) | | | Option

Expiration

Date | | | Number of Shares or Units of Stock

That Have Not

Vested (#) | | | Market

Value of Shares of Units of Stock That

Have Not

Vested ($)(1) | | | Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights

That

Have Not

Vested (#) | | | Equity

Incentive

Plan

Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or

Other

Rights

That

Have Not

Vested ($)(2) | |

Mr. Waddell | | | 61,473 | | | 20,491(3) | | $ | 60.85 | | | | 2/10/2024 | | | | 85,859(7) | | | $ | 8,576,456 | | | | 191,643(12) | | | $ | 19,143,219 | |

| | | 39,466 | | | 39,464(4) | | | 70.21 | | | | 2/17/2025 | | | | | | | | | | | | | | | | | |

| | | 27,591 | | | 82,771(5) | | | 58.25 | | | | 2/16/2026 | | | | | | | | | | | | | | | | | |

| | | — | | | 83,621(6) | | | 88.06 | | | | 2/21/2027 | | | | | | | | | | | | | | | | | |

Mr. O’Grady | | | 96,700 | | | — | | | 38.78 | | | | 10/18/2021 | | | | 29,830(8) | | | | 2,979,719 | | | | 68,776(13) | | | | 6,870,035 | |

| | | 48,110 | | | — | | | 43.65 | | | | 2/13/2022 | | | | | | | | | | | | | | | | | |

| | | 28,469 | | | — | | | 52.69 | | | | 2/11/2023 | | | | | | | | | | | | | | | | | |

| | | 18,489 | | | 6,162(3) | | | 60.85 | | | | 2/10/2024 | | | | | | | | | | | | | | | | | |

| | | 11,870 | | | 11,869(4) | | | 70.21 | | | | 2/17/2025 | | | | | | | | | | | | | | | | | |

| | | 8,623 | | | 25,866(5) | | | 58.25 | | | | 2/16/2026 | | | | | | | | | | | | | | | | | |

| | | — | | | 40,649(6) | | | 88.06 | | | | 2/21/2027 | | | | | | | | | | | | | | | | | |

Mr. Bowman | | | 21,352 | | | — | | | 52.69 | | | | 2/11/2023 | | | | 25,917(9) | | | | 2,588,849 | | | | 59,194(14) | | | | 5,912,889 | |

| | | 15,253 | | | 5,084(3) | | | 60.85 | | | | 2/10/2024 | | | | | | | | | | | | | | | | | |

| | | 11,870 | | | 11,869(4) | | | 70.21 | | | | 2/17/2025 | | | | | | | | | | | | | | | | | |

| | | 8,623 | | | 25,866(5) | | | 58.25 | | | | 2/16/2026 | | | | | | | | | | | | | | | | | |

| | | — | | | 26,132(6) | | | 88.06 | | | | 2/21/2027 | | | | | | | | | | | | | | | | | |

Mr. Fradkin | | | 7,117 | | | — | | | 52.69 | | | | 2/11/2023 | | | | 26,760(10) | | | | 2,673,056 | | | | 60,345(15) | | | | 6,027,862 | |

| | | 6,163 | | | 6,162(3) | | | 60.85 | | | | 2/10/2024 | | | | | | | | | | | | | | | | | |

| | | 11,870 | | | 11,869(4) | | | 70.21 | | | | 2/17/2025 | | | | | | | | | | | | | | | | | |

| | | 8,623 | | | 25,866(5) | | | 58.25 | | | | 2/16/2026 | | | | | | | | | | | | | | | | | |

| | | — | | | 27,874(6) | | | 88.06 | | | | 2/21/2027 | | | | | | | | | | | | | | | | | |

Ms. Schreuder | | | — | | | 6,162(3) | | | 60.85 | | | | 2/10/2024 | | | | 33,838(11) | | | | 3,380,078 | | | | 79,357(16) | | | | 7,926,971 | |

| | | 14,837 | | | 14,836(4) | | | 70.21 | | | | 2/17/2025 | | | | | | | | | | | | | | | | | |

| | | 11,497 | | | 34,488(5) | | | 58.25 | | | | 2/16/2026 | | | | | | | | | | | | | | | | | |

| | | — | | | 37,746(6) | | | 88.06 | | | | 2/21/2027 | | | | | | | | | | | | | | | | | |

(1) The market value of the restricted stock units included in this column is based on a price of $99.89 per share (the closing market price of the Corporation’s common stock on December 29, 2017).

(2) The market value of the performance stock units included in this column is based on a price of $99.89 per share (the closing market price of the Corporation’s common stock on December 29, 2017).

(3) Options originally granted February 10, 2014, with 25% of the award vesting on each anniversary of the grant date. Accordingly, all remaining unvested options vest on February 10, 2018.

(4) Options originally granted February 17, 2015, with 25% of the award vesting on each anniversary of the grant date. Accordingly, the remaining unvested options vest in equal portions on each of February 17, 2018 and 2019.

(5) Options originally granted February 16, 2016, with 25% of the award vesting on each anniversary of the grant date. Accordingly, the remaining unvested options vest in equal portions on each of February 16, 2018, 2019 and 2020.

(6) Options originally granted February 21, 2017, with 25% of the award vesting on each anniversary of the grant date. Accordingly, the remaining unvested options vest in equal portions on each of February 21, 2018, 2019, 2020 and 2021.

(7) Consists of 13,661 units vesting on February 10, 2018, 11,840 units vesting on February 17, 2018, 15,451 units vesting on February 16, 2019, 11,839 units vesting on February 17, 2019, 15,451 units vesting on February 16, 2020, 8,809 units vesting on February 21, 2020, and 8,808 units vesting on February 21, 2021.

(8) Consists of 4,108 units vesting on February 10, 2018, 3,561 units vesting on February 17, 2018, 4,829 units vesting on February 16, 2019, 3,561 units vesting on February 17, 2019, 4,828 units vesting on February 16, 2020, 4,472 units vesting on February 21, 2020 and 4,471 units vesting on February 21, 2021.

(9) Consists of 3,389 units vesting on February 10, 2018, 3,561 units vesting on February 17, 2018, 4,829 units vesting on February 16, 2019, 3,561 units vesting on February 17, 2019, 4,828 units vesting on February 16, 2020, 2,875 units vesting on February 21, 2020 and 2,874 units vesting on February 21, 2021.

(10) Consists of 4,108 units vesting on February 10, 2018, 3,561 units vesting on February 17, 2018, 4,829 units vesting on February 16, 2019, 3,561 units vesting on February 17, 2019, 4,828 units vesting on February 16, 2020, 2,937 units vesting on February 21, 2020 and 2,936 units vesting on February 21, 2021.

(11) Consists of 4,108 units vesting on February 10, 2018, 4,451 units vesting on February 17, 2018, 6,438 units vesting on February 16, 2019, 4,451 units vesting on February 17, 2019, 6,438 units vesting on February 16, 2020, 3,976 units vesting on February 21, 2020 and 3,976 units vesting on February 21, 2021.

(12) Consists of the following maximum number of shares Mr. Waddell may receive under performance stock units: 59,198 shares underlying performance stock units granted in 2015; 77,254 shares underlying performance stock units granted in 2016; and 55,191 shares underlying performance stock units granted in 2017. The distribution of shares underlying the performance stock units granted in 2015 took place on January 23, 2018, with 52,899 shares actually being distributed to Mr. Waddell. The actual number of shares distributed with respect to performance stock units granted in 2016 and 2017 will be based upon the satisfaction of certain performance conditions. Accordingly, it is possible that no shares of common stock will be distributed under these performance stock units.

(13) Consists of the following maximum number of shares Mr. O’Grady may receive under performance stock units: 17,804 shares underlying performance stock units granted in 2015; 24,143 shares underlying performance stock units granted in 2016; and 26,829 shares underlying performance

stock units granted in 2017. The distribution of shares underlying the performance stock units granted in 2015 took place on January 23, 2018, with 15,909 shares actually being distributed to Mr. O’Grady. The actual number of shares distributed with respect to performance stock units granted in 2016 and 2017 will be based upon the satisfaction of certain performance conditions. Accordingly, it is possible that no shares of common stock will be distributed under these performance stock units.

(14) Consists of the following maximum number of shares Mr. Bowman may receive under performance stock units: 17,804 shares underlying performance stock units granted in 2015; 24,143 shares underlying performance stock units granted in 2016; and 17,247 shares underlying performance stock units granted in 2017. The distribution of shares underlying the performance stock units granted in 2015 took place on January 23, 2018, with 15,909 shares actually being distributed to Mr. Bowman. The actual number of shares distributed with respect to performance stock units granted in 2016 and 2017 will be based upon the satisfaction of certain performance conditions. Accordingly, it is possible that no shares of common stock will be distributed under these performance stock units.

(15) Consists of the following maximum number of shares Mr. Fradkin may receive under performance stock units: 17,804 shares underlying performance stock units granted in 2015; 24,143 shares underlying performance stock units granted in 2016; and 18,398 shares underlying performance stock units granted in 2017. The distribution of shares underlying the performance stock units granted in 2015 took place on January 23, 2018, with 15,909 shares actually being distributed to Mr. Fradkin. The actual number of shares distributed with respect to performance stock units granted in 2016 and 2017 will be based upon the satisfaction of certain performance conditions. Accordingly, it is possible that no shares of common stock will be distributed under these performance stock units.

(16) Consists of the following maximum number of shares Ms. Schreuder may receive under performance stock units: 22,255 shares underlying performance stock units granted in 2015; 32,190 shares underlying performance stock units granted in 2016; and 24,912 shares underlying performance stock units granted in 2017. The distribution of shares underlying the performance stock units granted in 2015 took place on January 23, 2018, with 19,887 shares actually being distributed to Ms. Schreuder. The actual number of shares distributed with respect to performance stock units granted in 2016 and 2017 will be based upon the satisfaction of certain performance conditions. Accordingly, it is possible that no shares of common stock will be distributed under these performance stock units.

Option Exercises and Stock Vested

The following table sets forth information regarding exercises of stock options and vesting of stock awards for each named executive officer in 2017.

| | | | | | | | | | | | | | | | |

| | | |

| | | Option Awards | | | Stock Awards | |

| | | | | |

| Name | | Number of Shares Acquired on Exercise (#) | | | Value Realized on Exercise ($)(1) | | | Number of Shares Acquired On Vesting (#) | | | Value Realized On Vesting ($)(2) | |

Mr. Waddell | | | 528,545 | | | | $21,734,701 | | | | 88,466 | | | | $7,787,355 | |

Mr. O’Grady | | | — | | | | — | | | | 26,373 | | | | 2,319,351 | |

Mr. Bowman | | | 23,167 | | | | 925,868 | | | | 21,402 | | | | 1,882,763 | |

Mr. Fradkin | | | 21,059 | | | | 345,109 | | | | 26,633 | | | | 2,344,645 | |

Ms. Schreuder | | | 166,307 | | | | 6,579,147 | | | | 26,725 | | | | 2,353,595 | |

(1) The value realized on the exercise of stock options represents thepre-tax difference between the option exercise price and the fair market value of the common stock on the date of exercise.

(2) The value realized on the distribution of stock units represents the number of stock units that vested multiplied by the fair market value of the common stock on the date of vesting.

Pension Benefits

Information with respect to accrued benefits of each named executive officer under the Pension Plan as of December 31, 2017 is as follows.

| | | | | | | | | | | | | | |

| | | | | |

| Name | | Plan Name | | Number of Years Credited Service (#) | | | Present Value of Accumulated Benefit ($) | | | Payments During Last Fiscal Year ($) | |

Mr. Waddell | | Qualified Pension Plan | | | 35.0 | | | | $2,135,171 | | | | — | |

| | | Supplemental Pension Plan | | | 35.0 | | | | 20,295,139 | | | | — | |

Mr. O’Grady | | Qualified Pension Plan | | | 6.4 | | | | 70,188 | | | | — | |

| | | Supplemental Pension Plan | | | 6.4 | | | | 333,059 | | | | — | |

Mr. Bowman | | Qualified Pension Plan | | | 32.5 | | | | 1,422,166 | | | | — | |

| | | Supplemental Pension Plan | | | 32.5 | | | | 2,592,548 | | | | — | |

Mr. Fradkin | | Qualified Pension Plan | | | 32.7 | | | | 1,489,522 | | | | — | |

| | | Supplemental Pension Plan | | | 32.7 | | | | 6,235,712 | | | | — | |

Ms. Schreuder | | Qualified Pension Plan | | | 35.0 | | | | 1,927,866 | | | | — | |

| | | Supplemental Pension Plan | | | 35.0 | | | | 7,959,649 | | | | — | |

Pension Plan and Supplemental Pension Plan

Defined benefit pension benefits are provided generally to employees under the Pension Plan and to certain employees (including the named executive officers) under the Supplemental Pension

Plan. The Pension Plan is atax-qualified retirement plan that provides a retirement benefit as described below, which is subject to various limitations of the Internal Revenue Code and the Pension Plan. The Supplemental Pension Plan is a nonqualified retirement plan that provides the portion of an employee’s benefit that cannot be paid under the Pension Plan due to Internal Revenue Code and Pension Plan limits. The material terms and conditions of the Pension Plan and the Supplemental Pension Plan as they relate to the named executive officers include the following.

Eligibility

Eligible employees participate in the Pension Plan beginning the first day of the month following the completion of six months of vesting service. Employees with six months of vesting service who would have a portion of their benefit from the Pension Plan limited due to Internal Revenue Code or Pension Plan restrictions also participate in the Supplemental Pension Plan.

Benefit Formula—Traditional Formula

Prior to April 1, 2012, the benefits of the named executive officers, except for Mr. O’Grady, were determined under the Pension Plan’s “Traditional Formula.” To determine a participant’s benefit, the Traditional Formula first multiplies 1.8% by the average of the participant’s highest sixty consecutive calendar months of eligible pay. This amount is further multiplied by the participant’s years of credited service (up to a maximum of thirty-five years). The Social Security offset is then determined by multiplying 0.5% by (i) the lesser of the participant’s Social Security covered compensation limit or the average of the participant’s eligible pay for the three consecutive calendar years prior to retirement, with calendar year compensation not to exceed the Social Security taxable wage base in effect for a given calendar year, by (ii) the participant’s years of credited service (up to thirty-five years). This offset is subtracted from the benefit amount previously calculated to determine the annual benefit amount produced by the Traditional Formula.

For purposes of the Traditional Formula:

| ● | | “Eligible pay” means base salary (including anybefore-tax payroll deductions), shift differentials, overtime and certain types of performance-based incentive compensation, including cash, Northern Performance Incentives under the Northern Partners Incentive Plan (“NPIP”), compensation under the Management Performance Plan, payments from the former Annual Performance Plan and the cash value of stock options which were specifically paid in lieu of cash incentives from January 1, 2002 through April 30, 2004. Cash incentives deferred under the Northern Trust Corporation Deferred Compensation Plan (the “Deferred Compensation Plan”) are not included in eligible pay under the Pension Plan but are included in eligible pay under the Supplemental Pension Plan.

|

| ● | | “Social Security covered compensation” means the average of the Social Security taxable wage base for each of the thirty-five calendar years ending in the year in which the participant attains Social Security retirement age. In determining Social Security covered compensation as of a certain year, the taxable wage base for any subsequent year is assumed to be the same as for the determination year.

|

Benefit Formula—PEP Formula

Effective June 1, 2001, the Pension Plan was amended to provide that benefits of all newly hired employees of the Corporation and its affiliates would be calculated under the Pension Plan’s

“Pension Equity Plan (PEP) Formula.” Because Mr. O’Grady commenced employment on August 15, 2011, his benefits under the Pension Plan and Supplemental Pension Plan for his entire period of credited service are calculated under the PEP Formula. Under the PEP Formula, each year a participant earns a specific pension credit “percentage,” determined in accordance with a schedule in the Pension Plan that varies directly with his or her total number of years of credited service. Participants currently earn a 4% pension credit percentage for each of their first ten credited years of service, with the pension credit percentage increasing by one percentage point for the eleventh year of service and every fifth year thereafter through the end of their thirty-fifth year of service (after which no additional pension credit percentages are earned). A participant’s PEP Formula lump sum amount is equal to the sum of his or her pension credit percentages multiplied by the average of the participant’s highest sixty consecutive calendar months of eligible pay. Prior to April 1, 2012, eligible pay was defined the same for the PEP Formula as for the Traditional Formula, except that eligible pay under the PEP Formula also included cash sales and technical incentives under the NPIP up to 50% of the participant’s prior year’s base pay. Effective April 1, 2012, eligible pay under the PEP Formula includes all cash incentives under the NPIP. A participant’s annual benefit under the PEP Formula is equal to a single life annuity commencing at age 65 that is the actuarial equivalent of his or her PEP Formula lump sum amount. The single life annuity is calculated using interest rate and mortality assumptions specified in the Pension Plan.

Benefit Formula—Changes

As noted above, effective June 1, 2001, the Pension Plan was amended to provide that benefits of all newly hired employees of the Corporation and its affiliates would be calculated under a version of the PEP Formula. All employees already employed by the Corporation and its affiliates prior to such time were provided the opportunity to elect whether to accrue future benefits under such PEP Formula or the Traditional Formula. Effective April 1, 2012, the Pension Plan was further amended to provide that for credited service earned after March 31, 2012, all employees, including those who had previously elected the Traditional Formula, will accrue benefits pursuant to the revised PEP Formula described above. Accordingly, the named executive officers, other than Mr. O’Grady, will be entitled to an annual benefit equal to the sum of their accruals: (i) under the Traditional Formula for periods of credited service before April 1, 2012; and (ii) under the amended PEP Formula for their periods of credited service after March 31, 2012. Each such executive’spre-April 1, 2012 Traditional Formula benefits will be based on credited service and average compensation calculated as of March 31, 2012, provided that the executive’s average compensation as of March 31, 2012, will be indexed at a rate of 1.5% per year for any period on and after April 1, 2012, during which the executive earns credited service under the Pension Plan.

Although the April 1, 2012 changes made to the Pension Plan are anticipated to moderate any future pension value increases, the present value of benefits under the Traditional Formula is sensitive to changes in interest rates. The decrease in discount rate used to calculate the present value of pension benefits from 4.46% to 3.79% at December 31, 2017 resulted in an increase in the present value of benefits under the Traditional Formula for each of the named executive officers, except for Mr. O’Grady, whose benefits are all accrued under the PEP Formula. The other primary factors influencing pension values include an increase of the final average pay calculation and the application of the average pay across years of credited service under the Pension Plan.

Benefit Formula—Supplemental Pension Plan

Pension benefits are first calculated under the combined Traditional Formula and PEP Formulas or solely under the PEP Formula, as applicable, without regard to Internal Revenue Code limits and including in eligible pay the amounts deferred under the Deferred Compensation Plan. They are then recalculated applying Internal Revenue Code limits and excluding Deferred Compensation Plan deferrals from eligible pay to determine the amount of the benefit that is payable from the Pension Plan. The difference between the total benefit calculation and the Pension Plan calculation is paid from the Supplemental Pension Plan.

Benefit Entitlement

A participant is eligible to receive a benefit under the Pension Plan and Supplemental Pension Plan after completing three years of vesting service.

Retirement

A participant is generally eligible for a normal retirement benefit based on the combined Traditional and PEP Formulas or based solely on the PEP Formula, as described above, if his or her employment terminates on or after age 65 and he or she has completed at least five years of vesting service. A participant is eligible for an early retirement benefit if his or her employment terminates on or after age 55 and he or she has completed fifteen years of credited service. A participant who terminates employment with three years of vesting service but prior to becoming eligible for a normal or early retirement benefit is eligible for a “vested terminee” benefit commencing any time after termination. Mr. Waddell, Mr. Fradkin, and Ms. Schreuder are each eligible for early retirement benefits.

Under the Traditional Formula, the early retirement benefit is equal to the normal retirement benefit described above, reduced by 0.5% for each month payments are received prior to age 62 (or prior to age 60 under certain circumstances). Participants eligible for a “vested terminee” benefit are entitled to benefit payments that are reduced by 0.5% for each month up to 120 months that payments are received prior to age 65, then actuarially reduced for each month that payments are received prior to age 55.

Under the PEP Formula, both the early retirement benefit and “vested terminee” benefit are equal to the normal retirement benefit (in the form of a monthly single life annuity as described above), adjusted for early commencement prior to age 65. The adjustment is made using interest rate and mortality assumptions specified in the Pension Plan.

Form of Benefit Payment

The normal form of benefit payment under the Pension Plan is a single life annuity in the case of an unmarried participant and a 50% joint and survivor annuity in the case of a married participant, although optional forms of payment are available, depending on marital status and age and years of service. A lump sum option is available in all cases. All optional forms are the actuarial equivalent of the normal form of payment. The normal form of benefit under the Supplemental Pension Plan is a five-year certain annuity, payable to the participant in five annual installments; if the participant dies prior to receiving full benefits, payments will continue for the remainder of the five years to a designated beneficiary. Any installment payments are credited with interest pursuant to a market-based formula set forth in the Supplemental Pension Plan. If the value of the Supplemental Pension Plan benefit is $125,000 or less, the benefit is paid in a single lump sum.

Assumptions

The assumptions used in calculating the present value of the accumulated benefit are set forth in “Note 21—Employee Benefits” to the consolidated financial statements included in Item 8 of the Corporation’s Annual Report on Form10-K for the year ended December 31, 2017. The Corporation does not grant extra years of credited service under the Pension Plan, other than as noted below under “Potential Payments Upon Termination of Employment or a Change in Control of the Corporation.”

Nonqualified Deferred Compensation

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Name | | Form of Deferred Compensation | | Executive Contributions in Last FY ($)(1) | | | Registrant Contributions in Last FY ($)(2) | | | Aggregate Earnings in Last FY ($)(3) | | | Aggregate Withdrawals/ Distributions ($) | | Aggregate Balance at Last FYE ($)(4) | |

Mr. Waddell | | Deferred Compensation Plan | | | — | | | | — | | | | — | | | — | | | — | |

| | | Supplemental TIP | | $ | 43,800 | | | $ | 21,900 | | | $ | 375,905 | | | — | | $ | 2,087,332 | |

| | | Deferred Stock Units | | | — | | | | — | | | | 1,243,998 | | | — | | | 11,463,376 | |

Mr. O’Grady | | Deferred Compensation Plan | | | — | | | | — | | | | — | | | — | | | — | |

| | | Supplemental TIP | | | 31,800 | | | | 15,900 | | | | 9,162 | | | — | | | 182,077 | |

| | | Deferred Stock Units | | | — | | | | — | | | | — | | | — | | | — | |

Mr. Bowman | | Deferred Compensation Plan | | | — | | | | — | | | | — | | | — | | | — | |

| | | Supplemental TIP | | | 35,500 | | | | 10,650 | | | | 38,005 | | | — | | | 316,811 | |

| | | Deferred Stock Units | | | — | | | | — | | | | — | | | — | | | — | |

Mr. Fradkin | | Deferred Compensation Plan | | | — | | | | — | | | | 28,629 | | | — | | | 153,252 | |

| | | Supplemental TIP | | | 21,300 | | | | 10,650 | | | | 181,843 | | | — | | | 1,008,367 | |

| | | Deferred Stock Units | | | — | | | | — | | | | 204,735 | | | — | | | 1,886,622 | |

Ms. Schreuder | | Deferred Compensation Plan | | | — | | | | — | | | | — | | | — | | | — | |

| | | Supplemental TIP | | | 28,800 | | | | 14,400 | | | | 107,651 | | | — | | | 912,268 | |

| | | Deferred Stock Units | | | — | | | | — | | | | 102,004 | | | — | | | 939,965 | |

(1) Amounts in this column also are included in each named executive officer’s compensation reported in the “Summary Compensation Table,” as “Salary.”

(2) Amounts in this column also are included in each named executive officer’s “All Other Compensation” in the “Summary Compensation Table.”

(3) The aggregate earnings in this column are not “above-market” and thus are not included in the “Summary Compensation Table.”

(4) All amounts in this column have previously been included in each named executive officer’s compensation reported in the “Summary Compensation Table” to the extent that compensation data for each such officer, generally, has been included in such table.

Deferred Compensation Plan

The Corporation provides certain highly compensated employees, including the named executive officers, the opportunity to defer up to 100% of their short-term incentive awards that would

otherwise be payable in a specified calendar year into the Deferred Compensation Plan. Deferred amounts represent general unsecured obligations of the Corporation. The Corporation has established a grantor trust (referred to as a “rabbi” trust), under which the assets of the Deferred Compensation Plan are held and invested, to assist the Corporation in satisfying its obligations under the Deferred Compensation Plan when a distribution event occurs. The Corporation does not provide any matching contributions or guaranteed rates of return with respect to deferred amounts. Earnings credited with respect to amounts deferred under the Deferred Compensation Plan are based on the performance of a variety of investment alternatives made available under the plan and selected by the participant. Participants are fully vested in the amounts they defer at all times.

Each participant in the Deferred Compensation Plan makes an annual irrevocable election prior to the beginning of each performance year. Awards are generally deferred until retirement, with the option to elect a short-term deferral of at least three years. At the time the participant makes a deferral election, he or she must also elect whether retirement deferrals will be distributed in a lump sum or in five- orten-year installments. If the participant’s employment ends for any reason other than retirement before the short-term deferral distribution date, the participant’s account balance will be distributed in a lump sum. If the participant is deemed to be a “key employee,” as defined by the Internal Revenue Code, anyshort-term incentive award that was deferred after December 31, 2004 and is payable due to separation from service will be delayed for six months following the date of the separation.

Supplemental TIP

Supplemental TIP is a nonqualified retirement plan that provides the portion of an employee’s benefit that cannot be paid under TIP due to the Internal Revenue Code’s limit on the amount of a participant’s compensation that can be taken into account in determining TIP benefits. Account information provided for Supplemental TIP also includes account balances in the Northern Trust Corporation Supplemental Employee Stock Ownership Plan, which was frozen effective January 1, 2005, when the qualified Northern Trust Employee Stock Ownership Plan was merged into TIP. The material terms and conditions of Supplemental TIP as they relate to the named executive officers include the following.

Eligibility

An employee is eligible to participate in Supplemental TIP for any calendar year if he or she participates in TIP and as of the prior November 30 his or her base salary exceeded the Internal Revenue Code compensation limit. Employees are eligible to participate in TIP and elect salary deferrals immediately upon their hire, and are eligible for employer matching contributions beginning the first day of the month following the completion of six months of vesting service. All named executive officers participate in both plans.

Contributions

Each participant must make an election prior to the beginning of a calendar year to contribute to Supplemental TIP a portion of his or her base salary that exceeds the Internal Revenue Code compensation limit. The Corporation makes a matching contribution under Supplemental TIP using the formula in TIP, which is 50% of the first 6% of deferred salary, for a maximum matching contribution of 3% of salary.

Vesting

Each participant generally vests in the employer contributions under TIP and Supplemental TIP on a graduated basis of 20% per year over five years and is fully vested after five years. The named executive officers are fully vested in their TIP and Supplemental TIP accounts.

Investments

Each participant’s Supplemental TIP account is credited with earnings or losses based on various mutual fund investment alternatives made available under Supplemental TIP and selected by the participant (which are generally similar to the investment alternatives available to participants under TIP). On a daily basis, participants can change their Supplemental TIP investment alternatives among the alternatives offered in Supplemental TIP.

Distributions

No withdrawal or borrowing of Supplemental TIP assets is permitted during a participant’s employment. Distribution of the entire Supplemental TIP account balance generally is made to a participant within ninety days after the participant’s termination of employment. If the participant is deemed to be a “key employee,” as defined by the Internal Revenue Code, the portion of his or her Supplemental TIP account accruing after December 31, 2004 is distributed as a single lump sum following thesix-month anniversary of the termination of employment.

Deferred Stock Units

Certain restricted stock units granted prior to 2010 were required to be deferred until the earlier of: (i) the year in which the Compensation and Benefits Committee reasonably anticipates that, if the payment is made during that year, the deduction of the payment will not be barred by Internal Revenue Code Section 162(m); or (ii) the period beginning with the date of the participant’s separation from service (as defined in the Corporation’s Amended and Restated 2002 Stock Plan) and ending on the later of the last day of the Corporation’s taxable year in which the participant incurs a separation from service or the fifteenth day of the third month following such separation from service. “Aggregate Earnings in Last FY” in the Nonqualified Deferred Compensation table above represent the change in the value of deferred stock units, which is based on the change in the value of the underlying shares of common stock into which the stock units convert.

Potential Payments Upon Termination of Employment or a Change in Control of the Corporation

In addition to benefits to which the Corporation’s employees would be entitled upon a termination of employment generally, the Corporation provides certain additional benefits to eligible employees upon certain types of termination of employment, including a termination of employment involving a change in control of the Corporation. Described below are the benefits that the named executive officers would receive upon certain types of termination of employment, upon a change in control of the Corporation and upon a termination following a change in control of the Corporation.

Equity Compensation Plans and Agreements

As described above under “Description of Certain Awards Granted in 2017” beginning on page 57, the Corporation’s equity compensation plans and agreements provide enhanced benefits to

named executive officers upon a termination of employment with the Corporation or a subsidiary due to death, disability, or retirement (when such termination is not a termination described in his or her employment security agreement as discussed below).

In the case of a termination of a named executive officer’s employment due to death, disability or severance, stock options granted under equity compensation plans will accelerate. In the case of a termination of a named executive officer’s employment due to retirement (after satisfying applicable age and service requirements), stock options granted under equity compensation plans will continue vesting. In the case of a termination of a named executive officer’s employment due to death or disability, equity award agreements for restricted stock units and performance stock units granted prior to February 17, 2015 provide for prorated vesting of units and awards granted on or after February 17, 2015 provide for the full vesting of such units. In the case of a termination of a named executive officer’s employment due to severance, equity award agreements for restricted stock units and performance stock units provide for prorated vesting of units. In the case of a termination of a named executive officer’s employment due to retirement (after satisfying applicable age and service requirements), equity award agreements for restricted stock units and performance stock units granted prior to February 21, 2017 provide for prorated vesting of units and awards granted on or after February 21, 2017 will continue vesting.

Employment Security Agreements

As discussed above under “Severance Benefits and Employment Security Arrangements” beginning on page 49, the Corporation currently has employment security agreements with the named executive officers and certain other executive officers. The Corporation’s decision to enter into these employment security agreements and the determination of the level of benefits under these agreements, as well as under various termination of employment scenarios were exercises in judgment, informed by: (i) the recognition that all named executive officers are employedat-will; (ii) the Corporation’s desire to provide the named executive officers with sufficient security to ensure they are not distracted and remain focused on maximizing stockholder value during and after a change in control; (iii) the Corporation’s goal of providing executive compensation at levels that are competitive with similar positions to those in its peer group companies; (iv) the nature and scope of the job responsibilities undertaken by the named executive officers; and (v) the terms of other types of compensation paid by the Corporation to the named executive officers. In particular, in setting the terms of the benefits payable to the named executive officers under various termination scenarios, the Compensation and Benefits Committee was guided in large part by a desire to be sufficiently responsive to market forces and the environment in which the Corporation seeks to attract, motivate and retain its named executive officers by providing benefits consistent and competitive with those of the peer group companies with which it competes for top executive talent. In initially establishing the form and level of post-termination benefits, the Committee received and reviewed relevant peer group company information provided by its independent compensation consultant at the time. In particular, this competitive peer group data influenced the decision of the Committee to provide for employment security agreements, to set the level of lump sum payments equal to three years of salary and bonus and to provide for the vesting of equity compensation awards, the continuation of coverage under certain health and welfare plans and other protections afforded in the event of a termination of employment in connection with a change in control.

Under the employment security agreements currently in place, the benefits provided to a named executive officer upon the occurrence of an actual change in control of the Corporation would consist of the following, even if there is no termination of employment:

| ● | | Full vesting of all stock options.

|

| ● | | All outstanding nonqualified stock options remain exercisable for five years following termination of employment (or until the end of the option term, if earlier).

|

| ● | | Full vesting of all outstanding restricted stock units.

|

| ● | | Full vesting and immediate distribution of all outstanding performance stock units.

|

| ● | | Full vesting in benefits accrued under the Supplemental Pension Plan and Supplemental TIP. All named executive officers are already vested in these benefits.

|

The employment security agreements also provide benefits upon the occurrence of the following terminations of employment that are in connection with an actual or pending change in control of the Corporation:

| ● | | a termination of the executive’s employment by the Corporation or a subsidiary without “good cause” that occurs either within two years after a change in control of the Corporation or during theone-year period pending a change in control of the Corporation; or

|

| ● | | an executive’s voluntary termination of employment with the Corporation or a subsidiary for “good reason” that occurs either within two years after a change in control of the Corporation or during theone-year period pending a change in control of the Corporation.

|

The benefits provided to a named executive officer upon such a termination of employment would consist of the following:

| ● | | A lump sum payment equal to three times the sum of: (i) the named executive officer’s annual salary in effect on the date of employment termination, or if higher, the date of the change in control; and (ii) the average of the named executive officer’s awards under the Corporation’s cash incentive plans for the last three fiscal years of participation in such plans prior to the date of termination, or, if higher, the date of the change in control.

|

| ● | | A lump sum payment of a prorated portion of the average amounts paid to the named executive officer under the Corporation’s cash incentive plans for the last three fiscal years of participation in such plans prior to the date of termination, or, if higher, the date of the change in control, less any amounts paid to the named executive officer under those plans with respect to completed performance periods occurring in the year the named executive officer’s employment terminates.

|

| ● | | Continued coverage under the Corporation’s health, dental, life, accident, disability, and other welfare benefit plans for three years or, if earlier, until the executive becomes covered under similar plans maintained by another entity that provides at least equal benefits. If the named executive officer cannot be covered under any plan of the Corporation due to legal or contractual restrictions, the Corporation would provide the executive with substantially similar benefits and coverage.

|

| ● | | Up to an additional three years of age and/or service credits for purposes of determining eligibility and subsidy for participation in the Corporation’s retiree medical plans and an additional three-year age and service credit for benefits under the Supplemental Pension Plan.

|

| ● | | Mr. Waddell, Mr. Fradkin and Ms. Schreuder would be entitled to an additional cash payment equal to an amount that would offset any excise tax liability arising under Section 280G of the Internal Revenue Code as a result of any payment or benefit arising under an employment security agreement. Since 2011, the Corporation has discontinued inclusion of taxgross-up payments in new employment security agreements for executive officers.

|

The foregoing notwithstanding, payments to Mr. Bowman and Mr. O’Grady may be subject to a reduction in benefits received to the extent it would cause them to receive an “excess parachute payment” (as defined in the Internal Revenue Code) unless the change in control payments, less the amount of any excise taxes payable by them, is greater than the reduced payment.

Change in Control Plan

In 2017, we issued to each of the executive officers party to an employment security agreement, including each of the named executive officers, a termination notice with respect to the agreement. Under the terms of the employment security agreements, such a notice must be provided at least two years in advance of the effective date of such termination. Following the effective date of the termination of the employment security agreements on June 1, 2019, each named executive officer will become a participant in the Change in Control Plan, providing participants with certain benefits upon a qualifying termination of employment within two years following a change in control. The Change in Control Plan will align better the change in control severance benefits provided to our named executive officers with market practice and will eliminate the use of individual employment security agreements. Significant changes to the change in control severance benefits provided to our named executive officers upon the termination of their employment security agreements and participation in the Change in Control Plan include: (i) the reduction of the lump sum severance multiple from three times to two times for all participants in the Change in Control Plan except the CEO; (ii) the elimination of extra age and service credits for the pension plan; (iii) the elimination of all excise taxgross-ups (including those previously grandfathered); and (iv) the elimination of the single-trigger vesting of any equity award upon a change in control, such that all equity awards will be subject to double-trigger vesting in connection with an actual change in control in accordance with the provisions set forth in the terms and conditions of such awards.

The following table quantifies the additional amounts described above that each named executive officer would receive upon the related triggering event assuming such event took place on December 31, 2017. As our named executive officers will not participate in the Change in Control Plan until the effective date of the termination of their employment security agreements on June 1, 2019, amounts provided below do not reflect participation in such plan.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | Retirement* | | | Death* | | | Disability* | | | Severance

(4) | | | Change in

Control | | | Termination

in connection

with a

Change in

Control | |

Mr. Waddell | | Stock Options | | $ | 6,407,081 | | | $ | 6,407,081 | | | $ | 6,407,081 | | | $ | 6,407,081 | | | $ | 6,407,081 | | | $ | 6,407,081 | |

| | | Restricted Stock Units | | | 6,179,753 | | | | 8,541,552 | | | | 8,541,552 | | | | 5,214,622 | | | | 8,598,389 | | | | 8,598,389 | |

| | | Performance Stock Units(1) | | | 12,677,044 | | | | 14,790,660 | | | | 14,790,660 | | | | 11,437,304 | | | | 14,790,660 | | | | 14,790,660 | |

| | | Cash Severance | | | | | | | | | | | | | | | | | | | — | | | | 10,800,000 | |

| | | Pro-Rata Bonus | | | | | | | | | | | | | | | | | | | — | | | | 2,600,000 | |

| | | Supplemental Pension Plan / TIP(2) | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | Welfare Benefits(3) | | | | | | | | | | | | | | | | | | | — | | | | 37,166 | |

| | | Reduction to Prevent Excise Tax | | | | | | | | | | | | | | | | | | | n/a | | | | n/a | |

| | | Excise TaxGross-Up | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | $ | 25,263,878 | | | $ | 29,739,293 | | | $ | 29,739,293 | | | $ | 23,059,006 | | | $ | 29,796,131 | | | $ | 43,233,296 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mr. O’Grady | | Stock Options | | | n/a | | | $ | 2,150,774 | | | $ | 2,150,774 | | | $ | 2,150,774 | | | $ | 2,150,774 | | | $ | 2,150,774 | |

| | | Restricted Stock Units | | | n/a | | | | 2,973,300 | | | | 2,973,300 | | | | 1,753,561 | | | | 2,990,381 | | | | 2,990,381 | |

| | | Performance Stock Units(1) | | | n/a | | | | 5,212,264 | | | | 5,212,264 | | | | 3,949,087 | | | | 5,212,264 | | | | 5,212,264 | |

| | | Cash Severance | | | | | | | | | | | | | | | | | | | — | | | | 5,255,000 | |

| | | Pro-Rata Bonus | | | | | | | | | | | | | | | | | | | — | | | | 951,667 | |

| | | Supplemental Pension Plan / TIP(2) | | | | | | | | | | | | | | | | | | | — | | | | 181,320 | |

| | | Welfare Benefits(3) | | | | | | | | | | | | | | | | | | | — | | | | 43,908 | |

| | | Reduction to Prevent Excise Tax | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | Excise TaxGross-Up | | | | | | | | | | | | | | | | | | | n/a | | | | n/a | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | $ | — | | | $ | 10,336,338 | | | $ | 10,336,338 | | | $ | 7,853,422 | | | $ | 10,353,419 | | | $ | 16,785,313 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mr. Bowman | | Stock Options | | | n/a | | | $ | 1,936,953 | | | $ | 1,936,953 | | | $ | 1,936,953 | | | $ | 1,936,953 | | | $ | 1,936,953 | |

| | | Restricted Stock Units | | | n/a | | | | 2,581,619 | | | | 2,581,619 | | | | 1,728,841 | | | | 2,595,703 | | | | 2,595,703 | |

| | | Performance Stock Units(1) | | | n/a | | | | 4,566,550 | | | | 4,566,550 | | | | 3,518,608 | | | | 4,566,550 | | | | 4,566,550 | |

| | | Cash Severance | | | | | | | | | | | | | | | | | | | — | | | | 4,200,000 | |

| | | Pro-Rata Bonus | | | | | | | | | | | | | | | | | | | — | | | | 775,000 | |

| | | Supplemental Pension Plan / TIP(2) | | | | | | | | | | | | | | | | | | | — | | | | 568,167 | |

| | | Welfare Benefits(3) | | | | | | | | | | | | | | | | | | | — | | | | 43,191 | |

| | | Reduction to Prevent Excise Tax | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | Excise TaxGross-Up | | | | | | | | | | | | | | | | | | | n/a | | | | n/a | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | $ | — | | | $ | 9,085,122 | | | $ | 9,085,122 | | | $ | 7,184,402 | | | $ | 9,099,207 | | | $ | 14,685,565 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mr. Fradkin | | Stock Options | | $ | 1,999,646 | | | $ | 1,999,646 | | | $ | 1,999,646 | | | $ | 1,999,646 | | | $ | 1,999,646 | | | $ | 1,999,646 | |

| | | Restricted Stock Units | | | 1,933,191 | | | | 2,663,287 | | | | 2,663,287 | | | | 1,611,480 | | | | 2,680,369 | | | | 2,680,369 | |

| | | Performance Stock Units(1) | | | 3,983,556 | | | | 4,644,080 | | | | 4,644,080 | | | | 3,570,298 | | | | 4,644,080 | | | | 4,644,080 | |

| | | Cash Severance | | | | | | | | | | | | | | | | | | | — | | | | 4,825,000 | |

| | | Pro-Rata Bonus | | | | | | | | | | | | | | | | | | | — | | | | 983,333 | |

| | | Supplemental Pension Plan / TIP(2) | | | | | | | | | | | | | | | | | | | — | | | | 315,228 | |

| | | Welfare Benefits(3) | | | | | | | | | | | | | | | | | | | — | | | | 43,191 | |

| | | Reduction to Prevent Excise Tax | | | | | | | | | | | | | | | | | | | n/a | | | | n/a | |

| | | Excise TaxGross-Up | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | $ | 7,916,393 | | | $ | 9,307,014 | | | $ | 9,307,014 | | | $ | 7,181,424 | | | $ | 9,324,095 | | | $ | 15,490,848 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ms. Schreuder | | Stock Options | | $ | 2,563,512 | | | $ | 2,563,512 | | | $ | 2,563,512 | | | $ | 2,563,512 | | | $ | 2,563,512 | | | $ | 2,563,512 | |

| | | Restricted Stock Units | | | 2,416,950 | | | | 3,372,897 | | | | 3,372,897 | | | | 1,981,261 | | | | 3,389,978 | | | | 3,389,978 | |

| | | Performance Stock Units(1) | | | 5,218,614 | | | | 6,099,313 | | | | 6,099,313 | | | | 4,659,023 | | | | 6,099,313 | | | | 6,099,313 | |

| | | Cash Severance | | | | | | | | | | | | | | | | | | | — | | | | 5,100,000 | |

| | | Pro-Rata Bonus | | | | | | | | | | | | | | | | | | | — | | | | 950,000 | |

| | | Supplemental Pension Plan / TIP(2) | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | Welfare Benefits(3) | | | | | | | | | | | | | | | | | | | — | | | | 43,908 | |

| | | Reduction to Prevent Excise Tax | | | | | | | | | | | | | | | | | | | n/a | | | | n/a | |

| | | Excise TaxGross-Up | | | | | | | | | | | | | | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | | $ | 10,199,076 | | | $ | 12,035,723 | | | $ | 12,035,723 | | | $ | 9,203,796 | | | $ | 12,052,804 | | | $ | 18,146,711 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Note: The value of each equity award included in this table is based on a price of $99.89 per share (the closing market price of the Corporation’s common stock on December 29, 2017).

* Upon retirement, death or disability each named executive officer remains eligible to receive a termination year bonus under the Management Performance Plan at the discretion of the Compensation and Benefits Committee.

(1) Performance stock unit award values are based upon the target number of shares underlying 2015, 2016 and 2017 awards outstanding as of December 31, 2017.

(2) The amount presented is an estimate of the difference between the amount the individual would receive at termination in connection with a change in control and the amount the individual would have received if the termination were not in connection with a change in control. The assumptions used in calculating the present value of this benefit enhancement associated with the additional age and service credits are the December 2017 Internal Revenue Code Section 417(e) lump sum segment rates and the 2018 Internal Revenue Code Section 417(e) lump sum mortality table.

(3) The value of this continued benefit coverage for three years is derived by multiplying the Corporation’s annual cost of providing such coverage in 2017 by three.